AN OVERVIEW OF THE "UNPRECEDENTED" 2020 LUMBER & STRUCTURAL SHEATHINGS MARKET

September 11, 2020

CONFLUENCE… “A COMING TOGETHER OF PEOPLE OR THINGS; CONCOURSE” AS DEFINED BY DICTIONARY.COM.

Starting in early May, many began to inquire about what was going on with lumber prices in North America. We were in the middle of a global pandemic, the U.S. unemployment rate hit an all-time high of 14.7% only one month earlier, and most believed that U.S. home construction would inevitably come to a screeching halt.

At the time, an industry colleague of mine began using a phrase that stuck with me through this entire event, that everyone is “expecting the Boogeyman to arrive and crash the party.” Thankfully, as it pertains to U.S. home construction, the Boogeyman either is running exceptionally late or decided he wasn’t interested, as U.S. Housing Starts have rebounded to nearly the same level we were experiencing pre-COVID at the start of 2020. Over the past four months, however, lumber prices have soared, availability has dried up, and buyers/traders know that there will be no lumber to purchase if they are not the first to the trough each morning.

My goal with this article is to give our customers full insight into what’s happened thus far, how we got here, and what we believe needs to happen for this madness to end. Put another way, as one of the traders on my team, describes it, quoting Avengers: End Game, “Find Thanos, and remove the glove for God’s sake!”

So what happened? Allow us to simplify the “Super V” correction into the confluence of six principal contributing factors – two that could be foreseen, one which was likely, one that was improbable and two wildcards that caught everyone off-guard.

THE “FORESEEN” CONTRIBUTING FACTORS

After the mid-year correction of 2018, North American Lumber and OSB producers barely managed through abysmal market prices, despite record-high manufacturing costs. As a result, 2019 was the year of curtailment and closure, an attempt to match supply levels with lower housing start expectations.

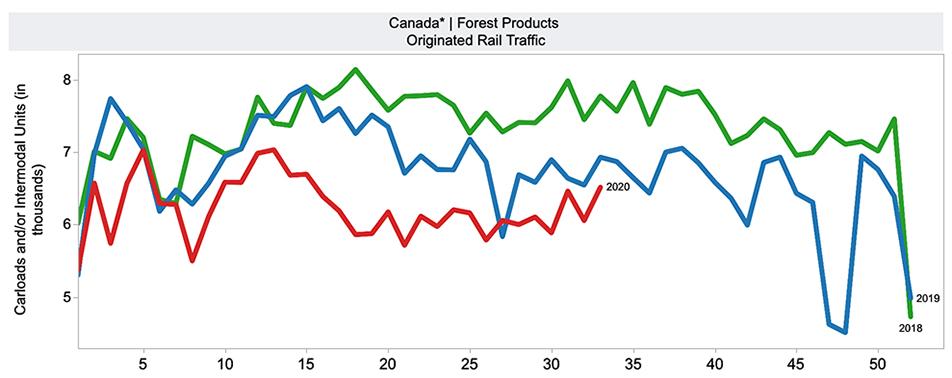

The second foreseen catalyst was also a result of the mid-year 2018 correction, which led to a near industry-wide shift from longer supply chains to leaner inventories. The reality is that in the wake of 2018, buyers became accustomed to just-in-time inventory need fulfillment. To illustrate that point, please reference the graph below, which clearly depicts the YOY drop in rail shipments since roughly Q2 2018.

Source: American Association of Railroads

Source: American Association of Railroads

THE "LIKELY" CONTRIBUTING FACTOR

This factor proved to be the inevitable production challenges created by COVID-19 in a manufacturing environment. While some forestry product mills require less proximity and associate presence, this is not the case at most older assets. While there have been limited reports of full forestry product manufacturer site closures due to COVID-19, there have been significant issues with employees testing positive for the virus. In such instances, entire shifts being lost for days or weeks at a time, creating an overall net loss to available production.

THE "IMPROBABLE" CONTRIBUTING FACTOR

This factor was the housing market's resilience in the face of both the pandemic and the staggering national unemployment. Some watched the early impact of the pandemic on New York City and predicated (correctly) the situation would lead to a fundamental shift away from crowded cities in favor of single-family homes. But the early adopters of this premonition were limited and drowned out by industry pundits anticipating a complete collapse. At its heart, the notion that single-family home construction would quickly regain momentum in 2020 was simple intuition. Predicated on the idea that to "feel safe," many Americans would favor a home environment with more space, one that doesn't include shared hallways, handrails, and elevators. We're now watching this prophecy come to fruition as millennials and their young families flee the city and waging bidding wars for suburban and even rural homes.

THE “WILDCARD” CONTRIBUTING FACTORS

The first was “wildcard” was how rapidly and effectively North American producers reduced capacity in the face of lessening orders in March from the Lumber and Building Materials segment. Simply put, producers proved they had learned from the Housing Recession during the Great Recession and knew better than to try and manufacture through lower demand. A few short weeks later, they’d demonstrate what they’d learned in 2019, which is how to rapidly throttle back production.

The second and most impactful “wildcard” factor was the strength of demand from the Home Center segment. For those Americans not affected by the staggering unemployment numbers, discretionary income increased from reduced dining out, entertainment activities, vacations and fueling of cars. For many, these extra funds found their way into home repairs and DIY renovation projects. The demand for building materials significantly surged when states and counties began issuing stay-at-home orders across the country in early spring. Lines wrapped around buildings and mini-vans were filled to the brim with any lumber product suitable for outdoor living upgrades, simple renovations, and repair and remodel projects. Goods flew off the shelves at a record pace.

Many of the forestry product manufacturers that service this segment of business reported a spike in their demand/consumption as high as 200% over the prior year between late April to June. While this demand has eased some through the summer, the bottleneck created by the timing of the confluence of the Home Center demand surge and mill curtailments has still not cleared.

2020 has proven to be a challenging year. The word “unprecedented” does not do justice to the magnitude of what the homebuilding industry has seen happen to our supply chains. The previous record high price for 2x4 #2 WSPF, set in 2018, has been shattered by more than 30%, and the industry utilized price reporting mechanism still has not caught up to cash market levels.

The market is currently in turmoil, with inventory outages and shortfalls being reported nationwide and lumber mill order files ranging from late September through late October. It appears that there may be no end in sight. For any commodity market corrections to occur, commodity buyers/traders need enough inventory to close their PO books for a while and wait out the producers. Given the current conditions, the only catalyst that feels plausible to give buyers/traders that higher ground would be reduced end-user demand (i.e., a slowdown in new home construction). Perhaps this occurs because of seasonal reductions that are standard during November and December, or if builders will reach a moment of sticker shock as the costs of framing packages explode on pre-sold new homes.

Time will tell, and we all know that at some point, the music will stop. Having said that, after a $100/m gain in one week on 2x4 #2 WSPF, I must pause and reflect on something a man much smarter than me once said, “Don’t tell me what the market can’t do because it will eventually do just that, the improbable.”