ZONDA'S LATE 2025 HOUSING MARKET UPDATE FOR BUILDERS: STARTS, SALES AND REMODELING TRENDS

While the economy moves through its own transition, the housing market is also in the middle of a reset. The latest insights from Zonda Chief Economist Ali Wolf during November’s Market Intelligence Webinar show a sector working through a shift from tightness toward balance.

Existing home sales are beginning to form a floor, new home sales are holding steady relative to history, community counts are rising and the remodeling outlook is improving as deferred projects accumulate. For professional builders, the next year looks like a transition period that rewards careful planning and offers reasons for cautious optimism.

EXISTING HOME SALES AND INVENTORY LEVELS IN LATE 2025

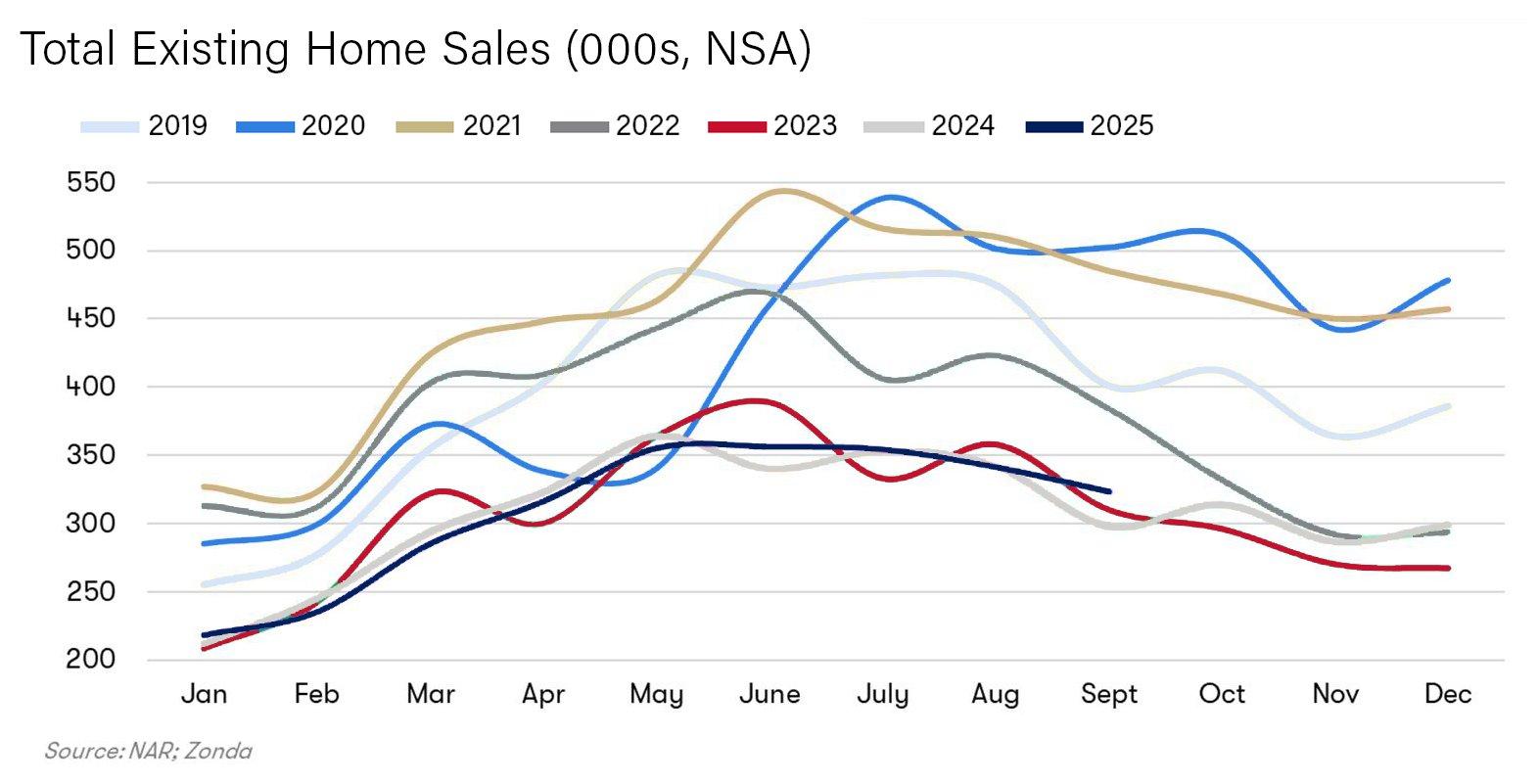

On the resale side, the market has finally moved beyond the acute scarcity that defined the pandemic years. Existing home sales in 2024 fell to their lowest level in about three decades. Through much of 2025, sales were running even below that very weak baseline. Only recently has the monthly data started to hint at a turning point, with September sales coming in above both 2023 and 2024. That is not enough to declare a robust rebound, but it does suggest that the market may be forming a bottom rather than drifting lower without end.

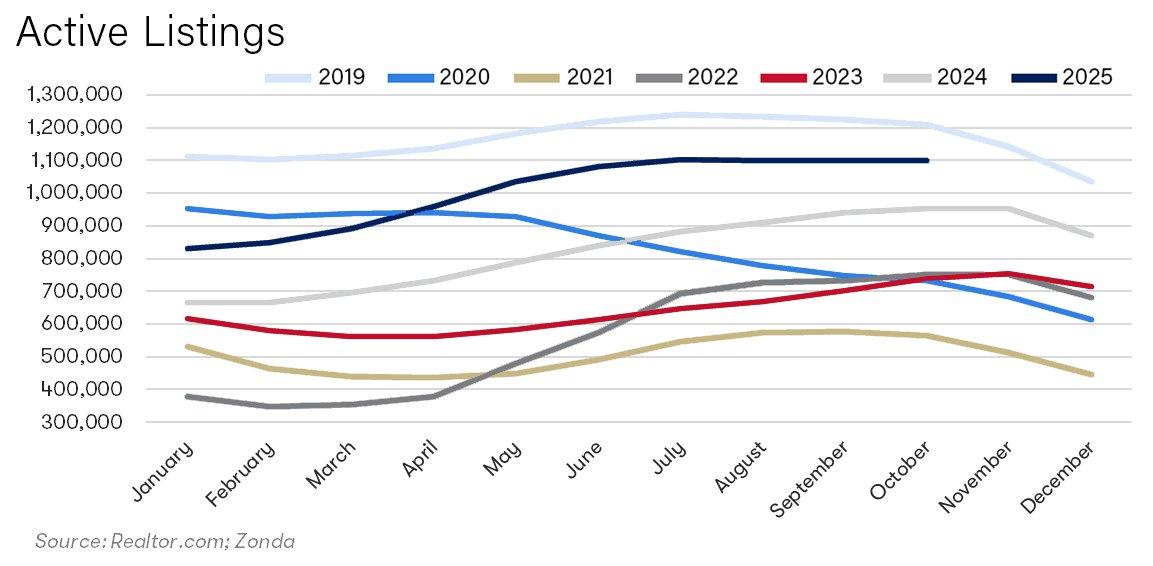

Inventory tells an even clearer story. Active listings across the country are now at their highest levels since the pandemic began. Roughly 60 percent of top markets have more inventory today than they did in 2019. In places like Colorado Springs and Austin, the shift is striking, with Colorado Springs showing roughly 90 percent more inventory than pre-pandemic and Austin around 55 percent more.

It is worth remembering that 2019 was not considered a loose market. Builders and agents were already describing conditions as tight. That means today’s inventory levels are not an oversupply crisis, but they are a clear departure from the ultra-tight dynamics of the last few years.

For buyers, this change is helpful. They once again have more options, can negotiate on price and repairs, and do not feel forced to make offers in hours. For sellers, including move-up owners who might otherwise consider a new home, the environment is more demanding. Listings face more competition, homes may sit longer than expected, and sellers sometimes need to adjust pricing or concessions to meet the market.

For builders, these conditions can complicate demand from potential move-up buyers who need to sell a home before they can move into a new one, even as they create an environment where new construction with clear pricing and incentives can stand out.

NEW CONSTRUCTION SALES AND COMMUNITY COUNT TRENDS

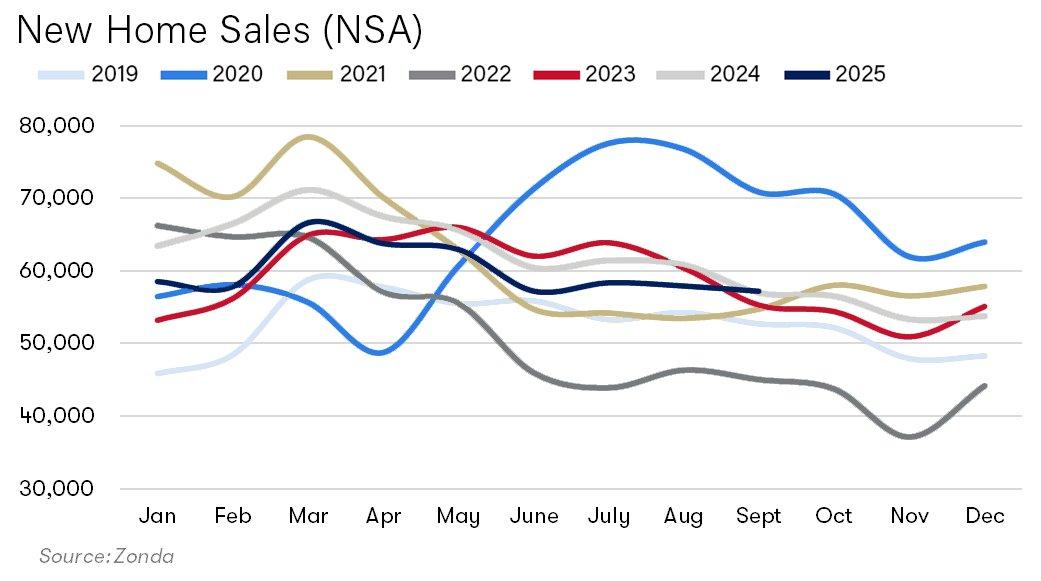

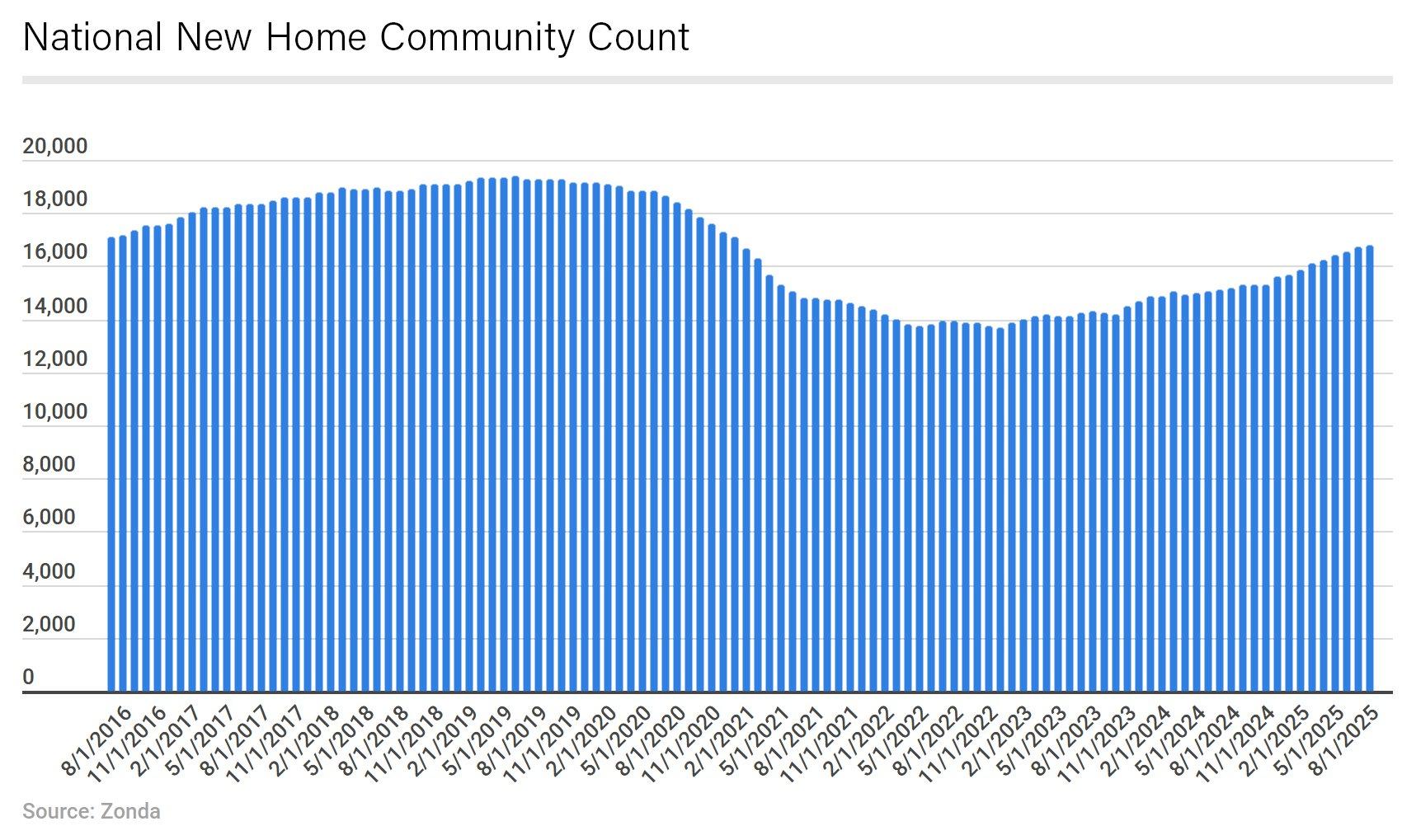

The new home segment looks comparatively resilient in the data. New home sales in 2025 are essentially in line with 2024 levels. Community count, defined as the number of actively selling projects with at least five units for sale, has risen for 10 consecutive months. That increase means builders have a broader footprint and more locations where they can capture demand. It is a structural positive for the industry.

Zonda’s sales per community analysis, which adjusts for seasonality and local supply, shows that most markets are operating at an “average” level relative to their own ten-year history. A handful of markets, particularly in South Carolina, are overperforming. In those markets, builders have adjusted prices downward by at least 10 percent from peak to secure strong sales, but the fact that the market is absorbing that product demonstrates real underlying demand.

On the other side of the country, a higher share of West Coast markets are underperforming, reflecting persistent affordability challenges and demographic shifts. Even there, the fact that builders are still selling at all in a tougher environment reinforces how valuable incentives, product positioning and community quality have become.

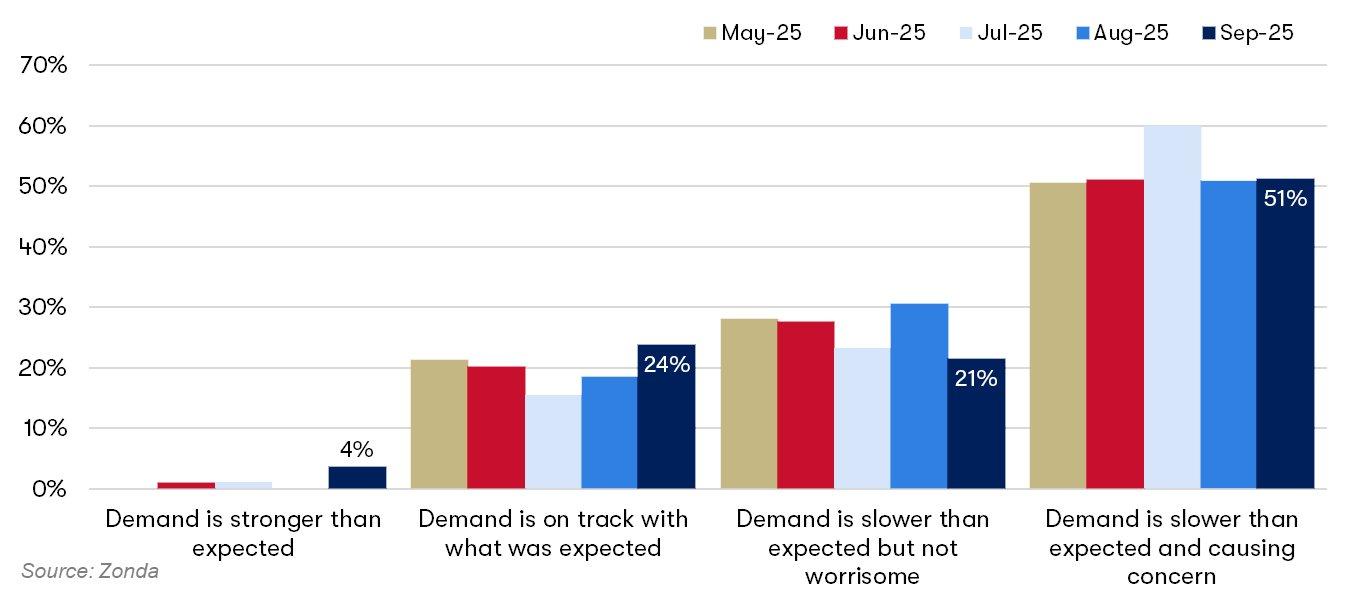

Despite these solid aggregate numbers, many builders say the market feels slow. Roughly 70 percent describe conditions as weaker than expected. The reason is not that sales have disappeared, but that each sale requires more effort. Margins are tighter, and incentives are more common. Buyers are cautious and take longer to make decisions. Consumer confidence is near record lows, so even households that have a reason to move and can technically afford the payment hesitate. For builders, this means that sales teams, digital experiences and financing tools are more important than ever in converting interest into contracts.

SINGLE-FAMILY HOUSING STARTS FORECAST FOR 2026

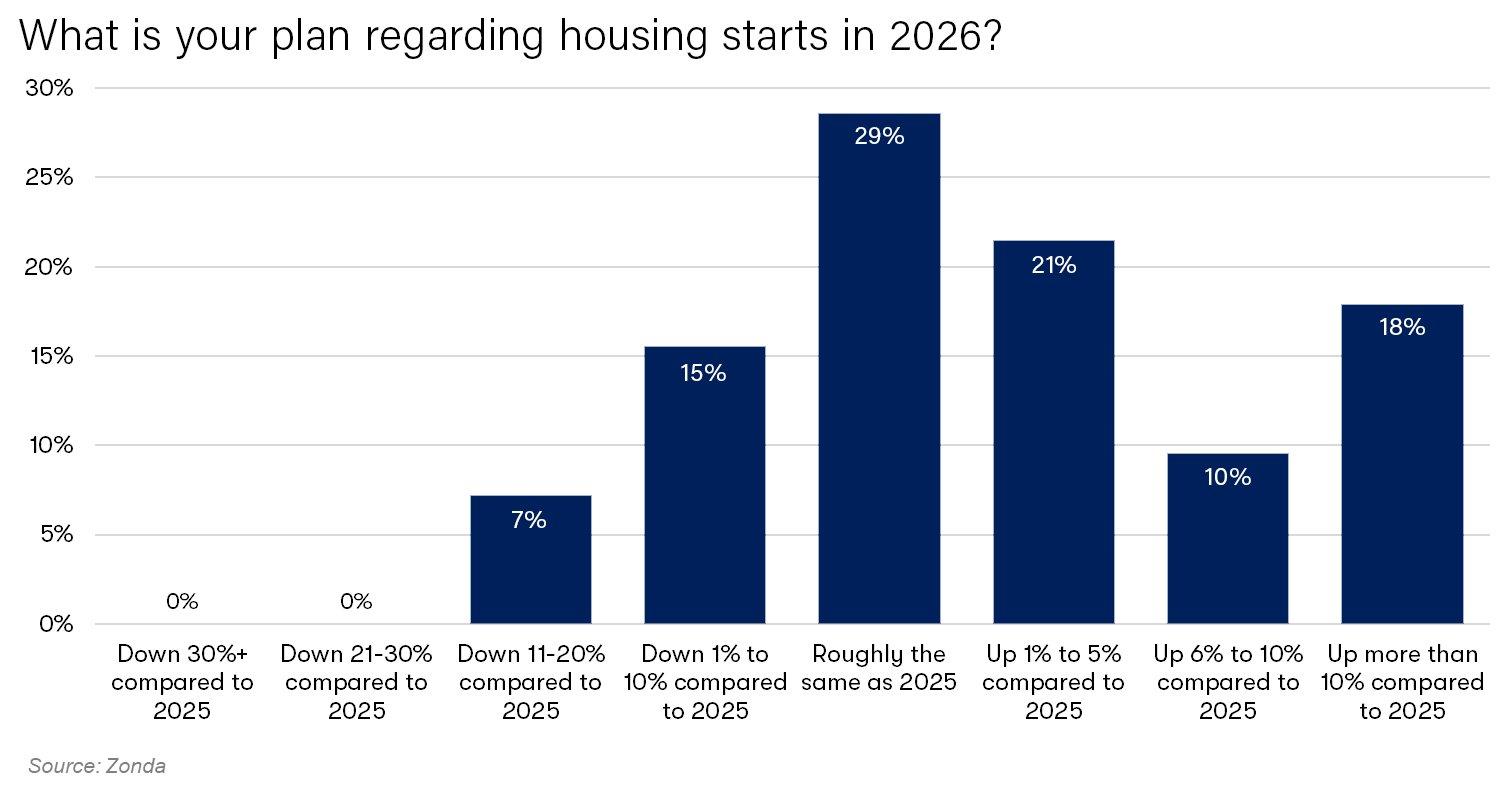

Looking forward, the forecast for housing starts in 2026 is neither wildly optimistic nor unduly pessimistic. Zonda’s national outlook for single-family and multi-family starts is essentially flat compared with 2025. The underlying modeling can support a scenario where 2026 becomes an inflection point where confidence improves and starts move meaningfully higher. It can also support a scenario where conditions stay soft for another year before improving. With both paths plausible, a flat projection reflects the current uncertainty.

Even so, about half of builders surveyed expect that starts will be up in 2026. In many markets, that optimism comes from how low production has already fallen. When starts have been running well below normal, even a modest pickup can feel like a meaningful improvement. It also reflects a belief in pent up demand. Many households have delayed plans to move during the past few years because of high rates, low confidence or lack of options. As rates ease modestly and stability returns, some of that demand should re-enter the market.

Community count trends support this cautiously positive view. Compared with last year, community counts are up about 11 percent, which means more neighborhoods are ready to absorb demand when it appears. The increase has not yet translated into a clear lift in starts because builders remain careful with speculative construction. Many are focusing on working through standing inventory before they ramp up specs again. Once that inventory is better aligned with demand and the economic outlook feels clearer, there is room for starts to respond more directly to the expanded community footprint.

REMODELING MARKET GROWTH AND BUILDING PRODUCT DEMAND

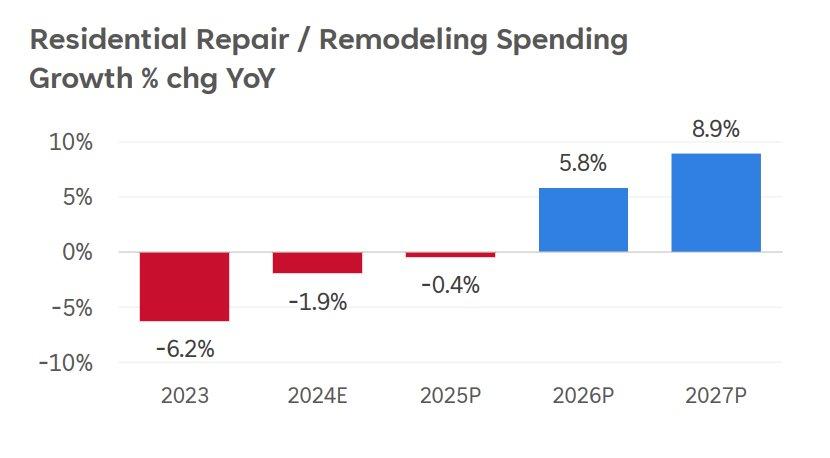

The remodeling and repair segment adds another encouraging element to the housing outlook, particularly for builders, dealers and suppliers that serve both new construction and R&R. Zonda’s building products forecast calls for repair and remodel spending to return to growth ahead of new construction. The latest projections show R&R spending growing in the mid-single digits in 2026 versus 2025, then accelerating to roughly high single-digit growth in 2027.

A major driver behind this rebound is the volume of deferred projects. Many homeowners who planned to renovate this year paused those plans due to uncertainty about the economy, tariffs or interest rates. Those projects have not vanished. They remain on homeowner wish lists and will likely move forward as conditions feel more stable. For builders who also do remodeling or who rely on product categories that serve both segments, this offers a welcome source of demand as new construction continues its transition.

For new construction-related building products, the path is a bit more muted in the short run. Because single-family starts have been running below trend and are expected to remain subdued into early next year, Zonda anticipates a modest decline in new construction-related product revenue in 2026 compared with 2025. After that, the forecast calls for a solid rebound in 2027 as starts pick up and as pricing normalizes. In practical terms, 2026 is likely to be a period where planning and positioning matter most, while 2027 has better odds of looking like a true growth year for volume and revenue.

MULTI-FAMILY HOUSING AND FUTURE SINGLE-FAMILY BUYERS

Multi-family dynamics are also part of the larger story for builders. Projects that were started during the development surge from a few years ago are now delivering, which has increased supply in many rental markets. At the same time, renewal rates remain high, and move-outs to purchase homes remain low, especially among younger renters. Gen Z renters overwhelmingly express a desire to own homes someday, yet they are staying put in apartments longer because of affordability challenges and uncertainty.

For single-family builders, that pattern means there is a deep future pipeline of potential buyers waiting in the rental market. As affordability improves at the margins and confidence stabilizes, some of these renters will begin to move into ownership. The exact timing is hard to predict, but the underlying desire is there.

Taken together, the 2026 housing outlook for builders is more balanced and hopeful than the daily noise might suggest. Existing home sales appear to be establishing a floor after a historic low. Inventory has moved from extremely tight to more manageable, giving buyers options without overwhelming the market. New home sales are holding steady, supported by rising community counts, even if each sale takes more effort. Starts are projected to be flat next year, but builders themselves lean slightly positive, and the groundwork is being laid for future growth. Remodeling is geared up for a multi-year upswing as deferred projects come back, and multifamily has created a large bench of future single-family buyers.

Builders who stay focused on product, operations and thoughtful growth in key submarkets can navigate this transition and be well-positioned when the market moves from hesitancy to action.