LATE 2025 HOUSING MARKET: JOBS, INFLATION AND INTEREST RATES

The current economic environment can feel noisy, but underneath the headlines, there is a story that builders can plan around. Growth has cooled from the post-pandemic surge, yet the economy is still expanding, job growth is slowing but not collapsing, and the Federal Reserve is gradually moving away from peak restriction.

HOW THE ECONOMY IS SHAPING HOUSING DEMAND

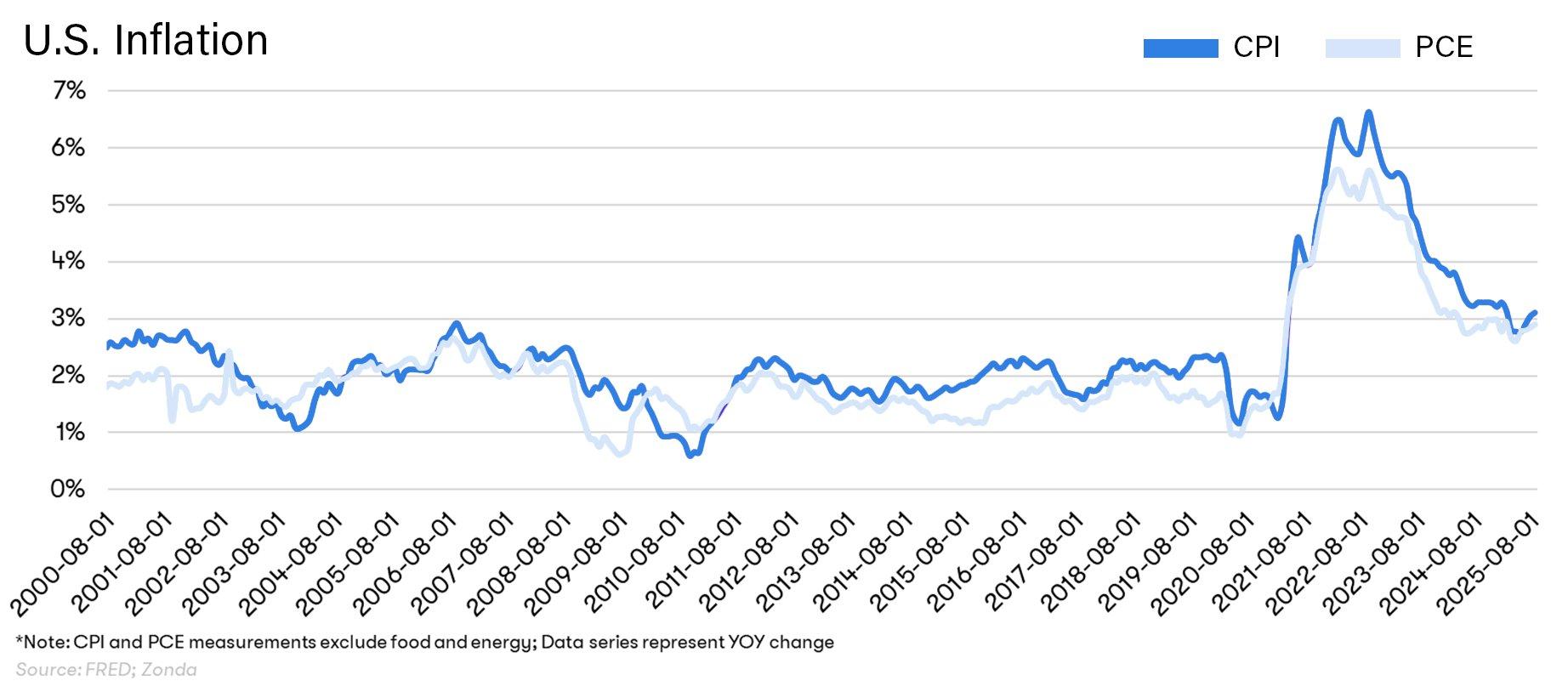

At the core of the economic story is the Federal Reserve and its long-standing mandate to balance maximum employment with price stability. For much of the past few years, inflation has dominated that conversation. Now the Fed is juggling two issues at once. The labor market is losing some momentum, and inflation has not yet returned consistently to the two percent target.

That shift explains why policy has eased from aggressive tightening to a more cautious middle ground. For builders, the important takeaway is that the environment is no longer in the emergency mode of 2022, and that alone is a step toward more stability.

On the employment side, the data shows a gradual cooling rather than a sudden break. The country is still adding jobs, but the pace has slowed as more companies choose not to backfill roles when people leave.

For housing demand, high-income job growth is especially important because those jobs are most likely to translate into new homebuyers. In roughly half of the top markets, high-income positions are shrinking. In the other half, they are still growing, particularly in parts of North Carolina and South Carolina as well as portions of the Midwest and Northeast. That pattern helps explain why some metros feel more resilient than others and gives builders a roadmap for where demand is most likely to hold up over the next cycle.

FEDERAL RESERVE POLICY AND ITS IMPACT ON MORTGAGE RATES

Inflation remains the other side of the Fed’s challenge. It measures how quickly prices are changing, not the level of prices, and that rate of change has stayed above the Fed’s comfort zone for most of the post-pandemic period. Shelter inflation has eased, but the overall trend has not yet convincingly settled near two percent. That is why policymakers are wary of cutting too aggressively. If they move too quickly and growth reaccelerates, inflation can pick back up and erode real wage gains, which would eventually weigh on the very households builders rely on.

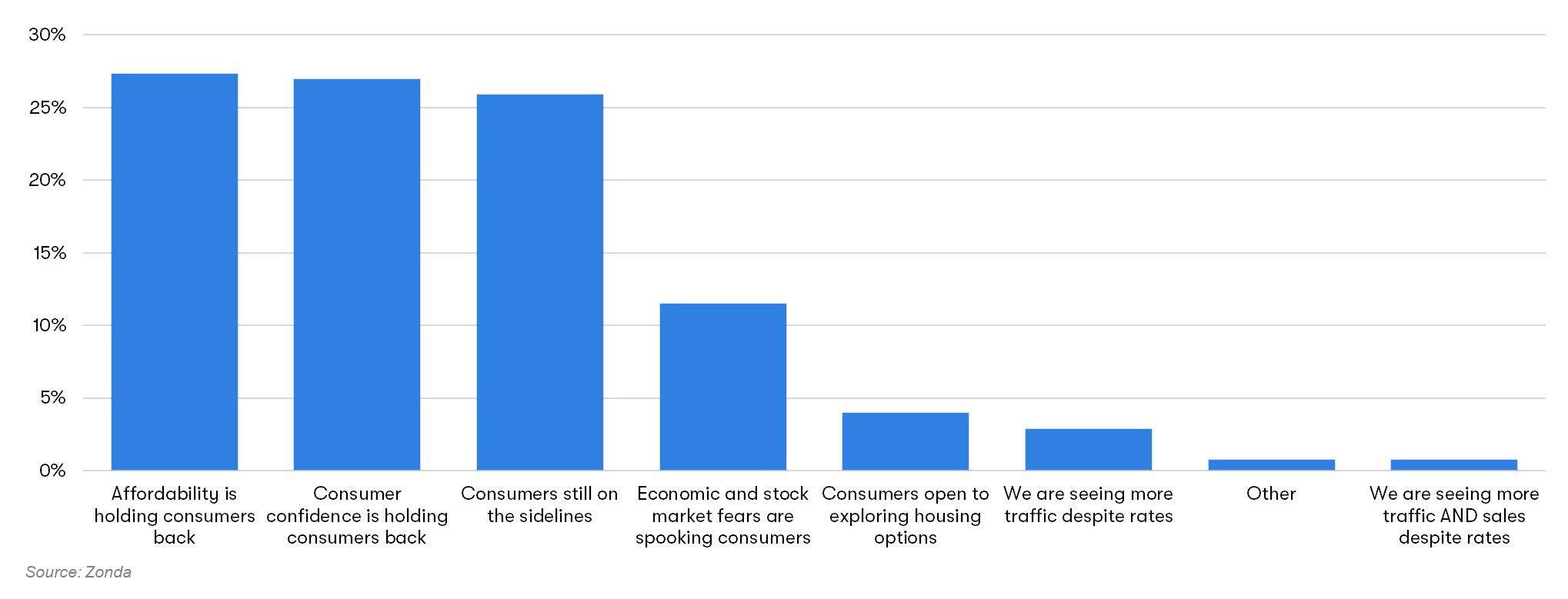

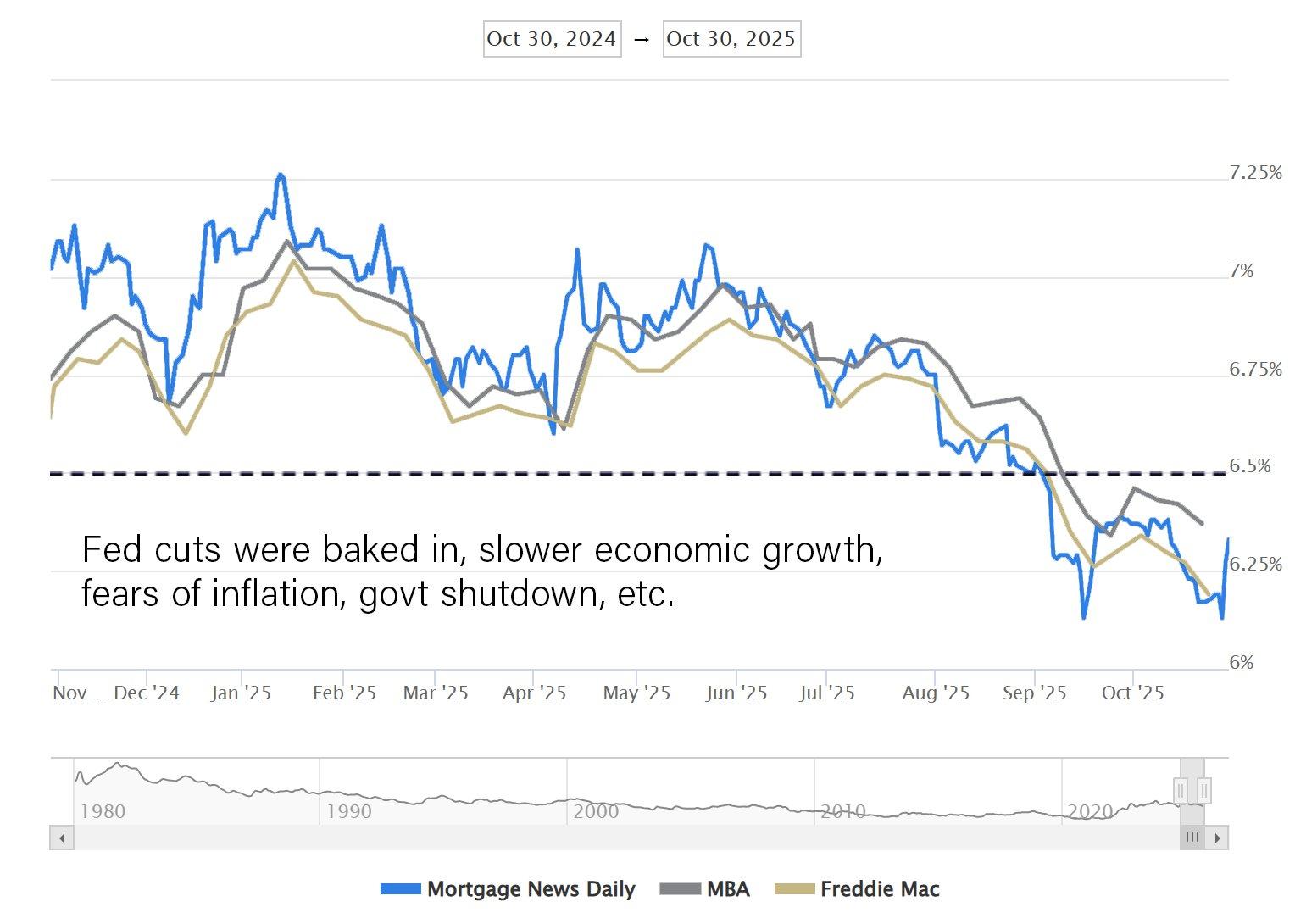

For builders, the key question is how all of this translates into mortgage rates. Mortgage rates do not move in lockstep with the Fed. They are set in the bond market, where investors constantly reprice expectations for growth, inflation and risk. That is why mortgage rates fell toward 6 percent ahead of recent Fed meetings and then rose after the cuts. Investors had already anticipated the policy changes and shifted their focus back to the broader economic picture. While that can be frustrating, the recent trajectory still offers some good news.

Zonda’s working assumption is that mortgage rates will remain in a range between 6 and 7 percent for now, which is still elevated compared with the ultra low levels of a few years ago but down from the peaks of 2023. The recent period where rates have averaged below 6.5 percent has already produced real benefits.

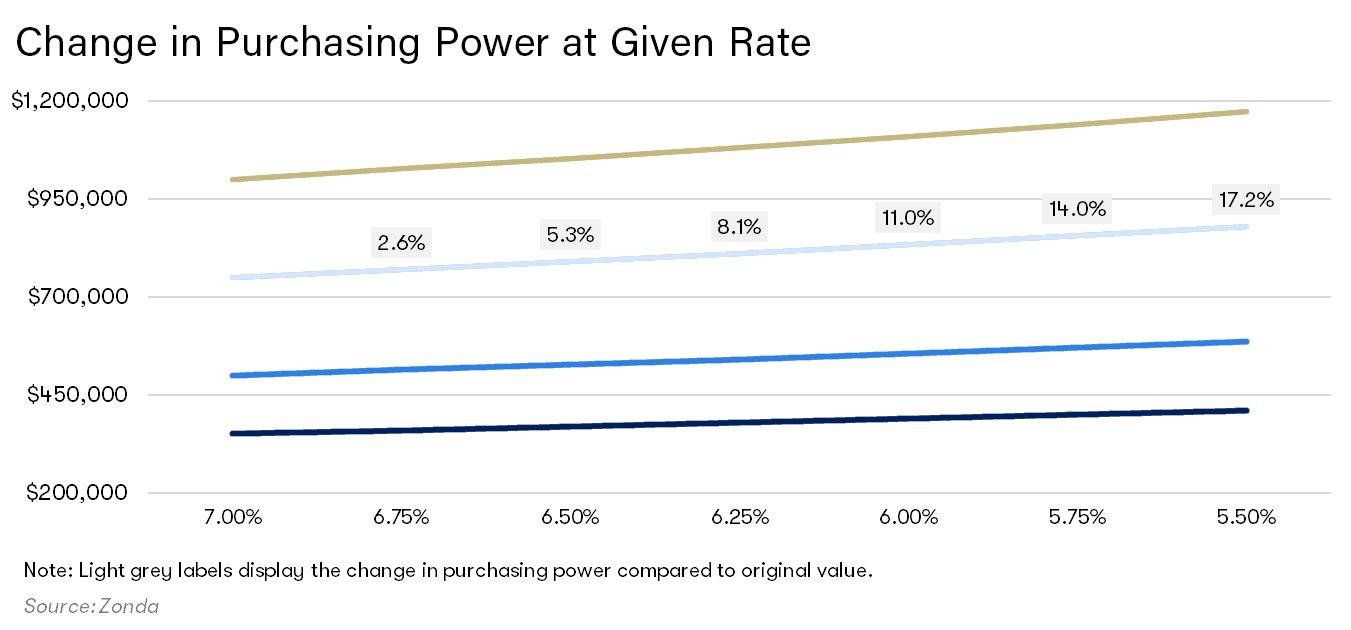

Moving from 7 percent to 6.5 percent improves purchasing power by roughly 8 to 11 percent, which matters for buyers on the margin, and it brings about two million additional households into the qualification pool. If rates fall and hold near 6 percent, that figure rises to about four million households. That is not a return to three percent mortgages, but it is a meaningful step in the right direction.

JOB MARKET TRENDS IN 2025 HOUSING MARKETS

Beyond national averages, the geography of job growth is shaping which markets feel stronger. Over a ten-year horizon, markets like Austin, Provo, Lakeland, Raleigh and Nashville stand out for robust job creation and especially for growth in high-income sectors. These locations attracted a great deal of building in the last cycle and are likely to remain important hubs for housing demand. Dallas occupies a special position because it couples solid job growth with one of the highest concentrations of Fortune 500 headquarters in the country. Those large companies account for a significant share of US GDP, so their presence creates a durable base for local housing demand.

At the same time, reshoring and onshoring trends supported by federal policy have driven major private manufacturing investments into markets across the country. Places like Columbus have seen high-profile announcements as companies commit to new plants and facilities. Not every project has followed the exact timeline originally advertised, but the overall direction of capital flows is supportive for local labor markets. For builders, that means paying close attention not only to current job numbers, but also to where long-term corporate investment is being made.

Migration patterns are also normalizing after an extraordinary pandemic period. The intense wave of relocation driven by remote work has subsided, yet the Southeast and other relatively affordable regions remain net winners. Some of the hottest destinations from the last few years, including parts of Florida and Austin, are now dealing with growing pains as infrastructure, schools and housing supply catch up. Those markets are going through a reset, with more inventory and some price giveback, but their long-term appeal is still anchored in lifestyle and economic fundamentals.

DEMOGRAPHIC TAILWINDS SUPPORTING LONG-TERM HOUSING DEMAND

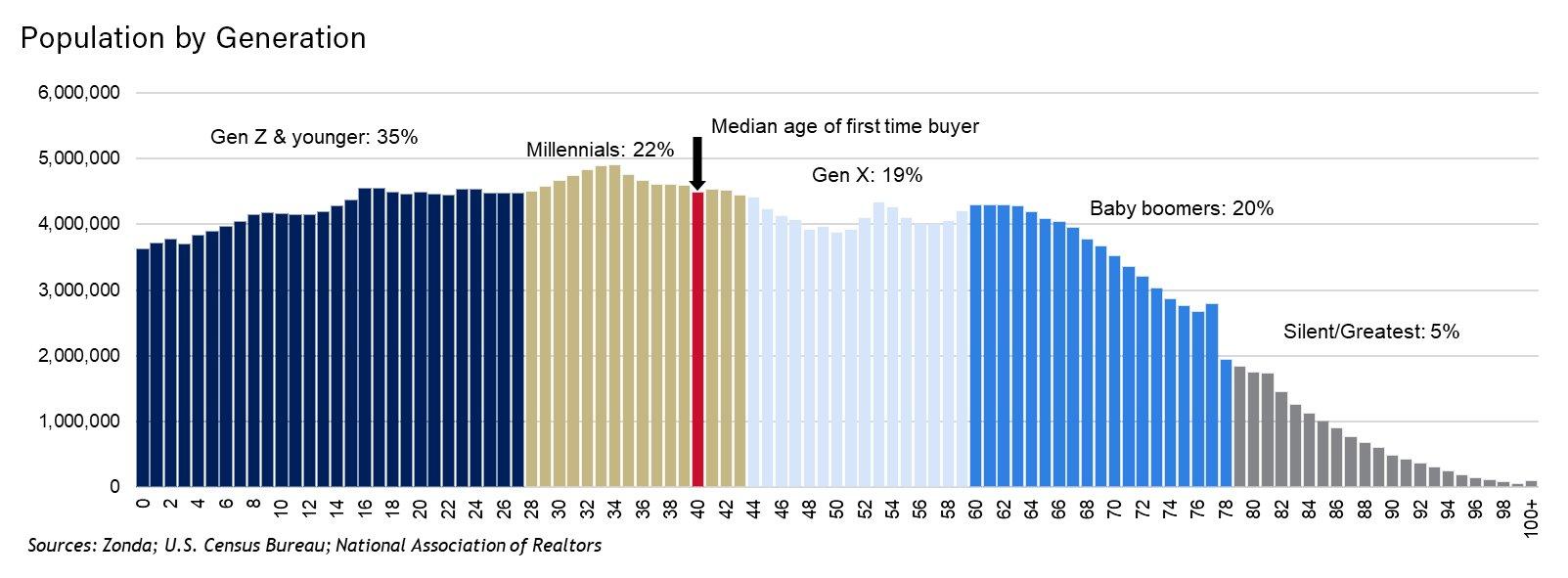

Demographics may be the most powerful positive force in the entire economic outlook for builders. Millennials are now the largest living generation, and they are solidly in their prime household formation years.

The median age of a first-time buyer has climbed to 40, the highest on record, which shows how affordability and uncertainty have delayed ownership, but it has not extinguished the desire to own. Many millennials have already purchased homes and built equity during the last cycle. Others are still renting and have yet to experience those wealth effects, which means there is still a significant wave of potential first-time buyers ahead.

Baby Boomers, the second-largest generation, are moving into retirement in large numbers, which creates natural reasons to reevaluate housing. Gen X sits between these groups and is juggling both move-up and move-down decisions as children leave home and careers peak. Wealth remains concentrated among households between 55 and 74, and many of these owners plan to transfer some of that wealth while they are still alive, supporting down payments and closing costs for younger buyers. That “bank of mom and dad” effect is already visible in many markets.

Combined with these age-based dynamics is a shift in diversity and household structure. Younger generations are more diverse than older ones, and there are more dual-income couples without children, more single women buyers and more smaller households overall. This evolution does not change the fact that people want homes. It changes what they want those homes to look like, where they want to live and how they make decisions.

For builders, the big picture economic message is cautiously encouraging. The labor market has cooled but remains functional, inflation has moderated from its worst levels, the Fed has moved away from its most restrictive stance, and mortgage rates have drifted down from their highs. Layered on top of that are long term job growth in key regions, meaningful corporate investment and powerful demographic momentum. This is not a booming environment, but it is an environment where disciplined builders can position themselves to benefit when confidence catches up with these underlying strengths.