RENTAL AND REMODELING MARKETS IN 2025: CAUTION TODAY, OPPORTUNITY TOMORROW

The housing market has no shortage of moving parts in 2025, but two areas—rentals and remodeling—stand out as both challenges and opportunities for builders. During the August Market Intelligence Webinar, Zonda Chief Economist Ali Wolf highlighted how these segments are shaping the industry’s outlook. For professional builders, the key takeaway is that short-term caution will give way to longer-term growth, especially as consumer behavior shifts and supply levels normalize.

THE RENTAL MARKET: STRONG DEMAND MEETS OVERSUPPLY

The U.S. rental and multifamily markets in 2025 are experiencing one of the most complex dynamics in recent memory. Demand is not the issue—in fact, it is historically strong. Both the first and second quarters of this year posted the highest levels of apartment absorption since 2000. Many renters are choosing to stay put and renew their leases rather than attempt to buy a home, especially as affordability challenges linger in the single-family ownership market. This has kept retention rates high and reinforced the role of rental housing as a stable option during a time of economic uncertainty.

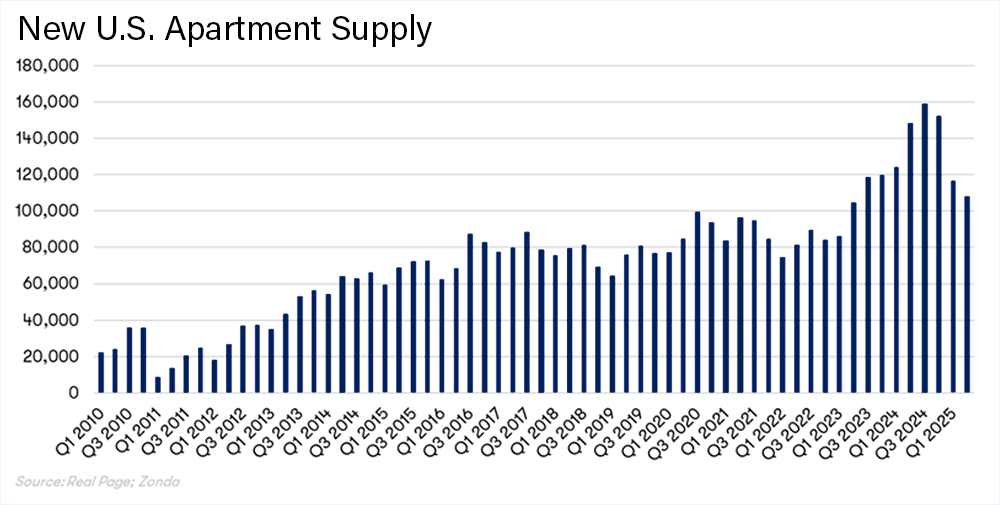

Yet the supply side tells a different story. After years of underbuilding, developers responded aggressively during the pandemic era. Deliveries peaked in late 2024, and while they have begun to ease, they are still elevated compared to historical norms.

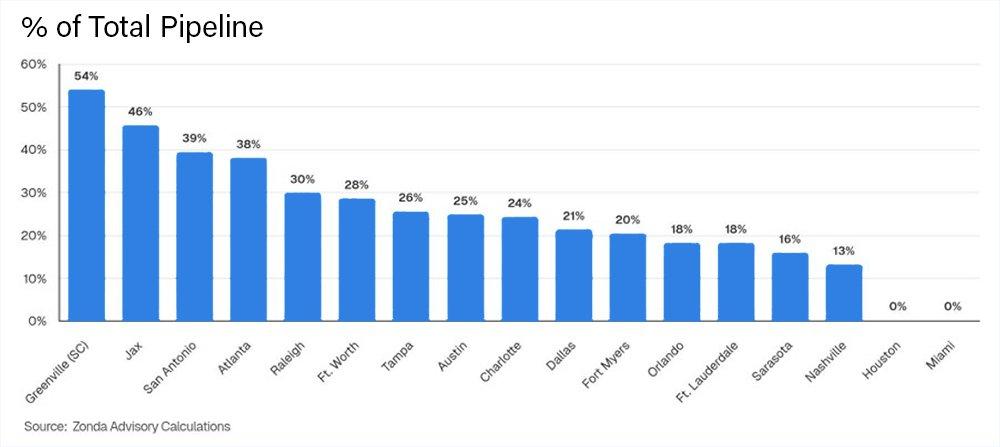

The issue is not just the number of new units but where they are concentrated. High-growth markets such as Greenville, Jacksonville, San Antonio, Atlanta and Raleigh are carrying a significant overhang of supply. In many of these metros, new units delivered in prior years remain unabsorbed, creating a backlog of supply in areas that, historically, have 0% overhang.

That overhang is putting downward pressure on rents and occupancy. This mismatch between rapid supply growth and slower absorption has forced many communities to turn to concessions—such as six to eight weeks of free rent—as a tool to attract tenants.

By contrast, coastal markets such as those in the West, Northeast and parts of the Carolinas remain more insulated. These regions benefit from higher barriers to entry, including land scarcity, regulation and slower entitlement processes. As a result, oversupply is far less of a concern, and occupancy levels continue to hold at 95 percent or above. Rents in these markets are still rising, showing how location and market fundamentals can outweigh broader national trends.

For developers, this uneven backdrop is shaping investment decisions. In oversupplied Sun Belt metros, new multifamily starts are slowing, with many projects delayed until existing inventory is absorbed. Nationally, multifamily starts have fallen below 400,000 units annually and are projected to remain in the mid-300,000s over the next few years. Developers are cautious not only because of the supply glut but also because of elevated construction costs, interest rate uncertainty and tighter financing conditions. Even in markets with strong long-term demand, the immediate risks are too high to justify aggressive new construction.

Despite these short-term challenges, sentiment within the multifamily sector is beginning to improve. Many industry participants now believe that the worst of the oversupply problem is behind them. As absorption continues and the pipeline of new projects slows, the market should gradually rebalance. Once interest rates ease and financing conditions improve, developers are expected to re-engage, albeit with more measured discipline than in the past.

For builders and suppliers, the lesson is clear. Rental demand is not going away, but oversupply in certain regions will weigh on pricing and occupancy in the near term. Coastal markets and select metros with stronger employment bases will remain healthier, but in high-growth markets where deliveries surged, patience and strategic positioning will be key.

REMODELING: A GOLDEN DECADE, DELAYED

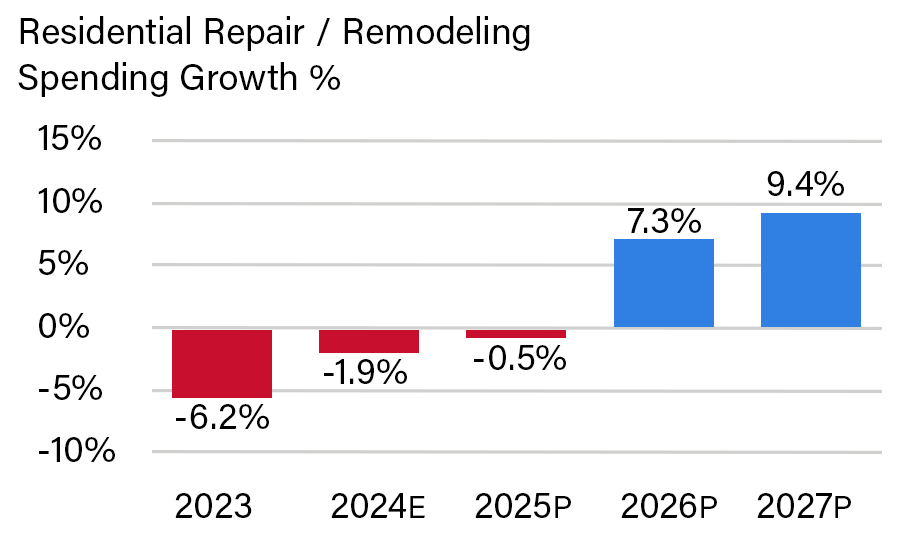

Zonda has recently called for the remodeling market to experience a “golden decade,” and while that has been delayed by economic uncertainty, Zonda’s outlook still supports that thesis. But for now, the sector is facing headwinds that are slowing spending and causing homeowners to hit pause on projects.

Spending growth on products installed in existing homes has been adjusted downward for 2025, but Zonda projects a return to growth in 2026 and beyond. The forecast now calls for remodeling-related spending to increase by more than 7 percent in 2026, with positive momentum continuing into 2027.

The biggest challenge today is consumer hesitation. Many homeowners are caught in what Wolf described as a “deer in the headlights” mindset. They recognize the need for home improvements but are reluctant to commit cash in a volatile economic environment. Rising costs from tariffs, questions about job security and general unease about the economic outlook all contribute to hesitation.

Unlike past downturns, however, this is not a matter of projects being abandoned altogether. Instead, improvements are being deferred, which sets the stage for a surge in activity once consumer confidence improves.

For builders and suppliers, this dynamic creates both challenges and opportunities. Short-term, there will be fewer projects moving forward, which pressures sales of building products and installed services. Long-term, however, the pent-up demand could create a wave of work once consumers feel more secure. Those who position themselves to capture that demand—by maintaining visibility with homeowners, offering financing solutions or highlighting the value of improvements during uncertain times—will be best prepared when the market shifts back to growth.

WHAT BUILDERS SHOULD WATCH

For builders and suppliers, the rental and remodeling segments will require close attention in the months ahead. Rental demand is strong but oversupply in certain regions will pressure pricing and push more communities to offer concessions. Remodeling faces short-term declines in spending but there are expectations for a resurgence as deferred projects move forward in the next two to three years.

The most effective strategy for builders is to prepare for both realities: exercise caution in rental-heavy markets where competition is stiff, and position for long-term growth in remodeling as households regain confidence and restart improvement projects.