WHY PEOPLE ARE BUYING HOMES DESPITE HIGH INTEREST RATES

September 13, 2023

Mortgage interest rates are over 7% after being between 6-7% for about a year. Monthly payments have increased 50% to 70% just since the beginning of last year. As Ali Wolf, Zonda’s Chief Economist, put it in the August Market Intelligence webinar, “This is a very clear and very dramatic affordability shock.”

SALES OF EXISTING HOMES ARE DOWN

Nationally, sales of existing homes are down by about 2% month-over-month, and about 16% compared to this time last year. Markets across the country vary widely, with Raleigh being down by about 20% year-over-year but Orlando is down by less than 5% compared to last year. Sales are also down across all markets compared to 2019 — which is considered a healthy year for the housing market.

But it’s not the case that nobody’s buying.

NEW HOME SALES ARE INCREASING

New home sales and existing home sales differ greatly. In fact, new home sales have been increasing this year and are now well above 2019 levels. On the face of it, that’s counter-intuitive. You’d expect sales to go down as interest rates go up. And sales did go down last year — lowering demand is, after all, the point of the Federal Reserve increasing interest rates. However, an unforeseen consequence of higher rates has been that, as demand came down, supply came down even more.

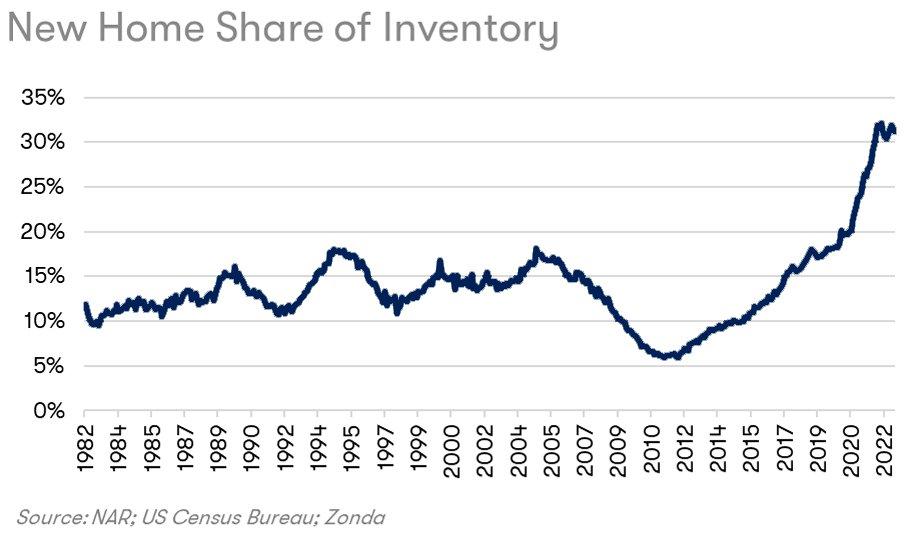

Fewer existing homes are being put up for sale, and when they do go on the market, they sell quickly. The result is that builders currently have a 33% share of the available homes for sale. Historically, it’s been 10 to 15%.

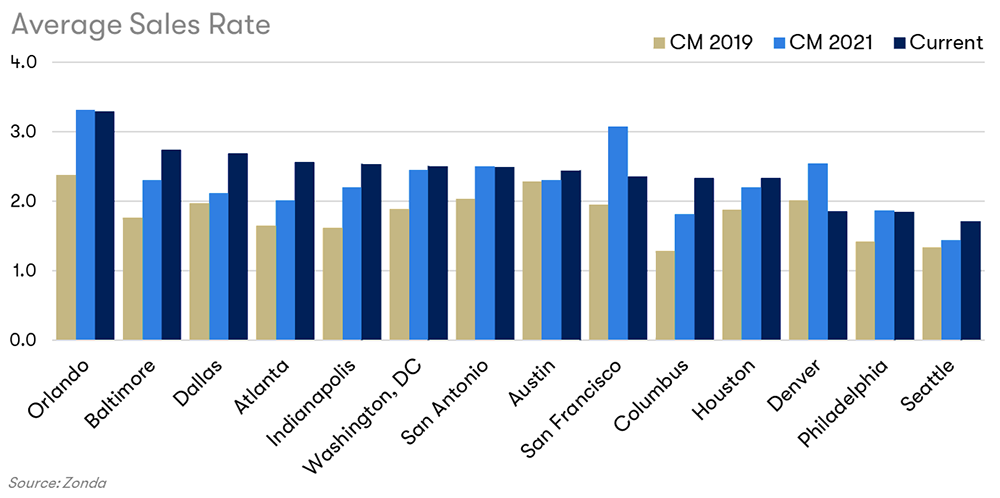

Overall, sales have exceeded expectations and, in almost all the major markets, the Average Sales Rate is higher than in 2019.

WHY HAVE NEW HOME SALES OUT-PERFORMED EXPECTATIONS?

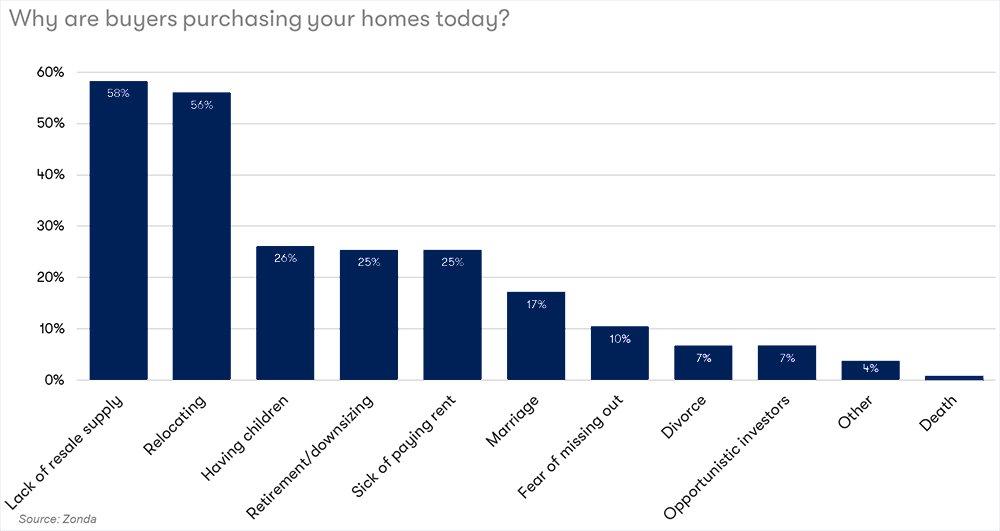

Given high interest rates and affordability challenges, why are buyers purchasing new homes? Zonda asked builders this question and the number one response is lack of resale supply, which Wolf estimates will be a factor for at least the next 12 months.

Relocation is a close second — which could be due to getting a job or wanting to live closer to family, for example. Relocation and most of the other responses fall into the “life happens” category. People aren’t putting their lives on hold. They get married, have babies, change jobs, get divorced, move closer to grandchildren, etc. Because of interest rates and high home prices, they may adjust — choosing smaller homes, less than ideal locations, attached instead of detached, etc. — but they still want to buy a home.

LIFE HAPPENS

The demand is coming from the “life happens” — or structural demand — category of buyers. This is a lot of people. Millennials are the largest living generation and they’re now at the age where they’re having children. They might not like the current interest rates, and they may have to compromise, but they still want to buy a home.

People are more likely to buy a home when they get married. 50% of first time buyers are married couples. Of course, living situations prior to marriage vary. Some couples will have rented separate places prior to marriage, and by combining their income they can now manage to buy a home together.

Deaths don’t always result in an immediate sale of a home depending on who else the deceased lived with and what the rest of the family wants to do with the property. If the deceased lived alone and the home does go on the market, that increases supply without taking from it. However, sometimes a death results in the transfer of wealth to younger generations, which means the home may or may not immediately come up for sale. At the same time, it also can help the younger generations overcome affordability obstacles to buying homes.

Zonda’s research indicates that divorce initially increases demand for rental homes, but in the longer term converts to increased demand for for-sale homes.

Baby boomers reaching retirement age are an important group. All boomers will be of retirement age by 2030. From 2014 to 2021, millennials were the most active home buying group. But in 2022, boomers overtook them as the most active buyers — but they were also the most active sellers. Thirty-nine percent of all home purchases in 2022 were by boomers, but because they’re usually selling as well as buying, retirement may not lead to an overall increase in demand.

As mentioned above, relocation was actually the number two response from builders saying what’s driving their sales. Although migration is down from peak levels during the pandemic and the height of the work-from-home trend, it’s still a big driver of demand, especially into some of the more affordable markets.

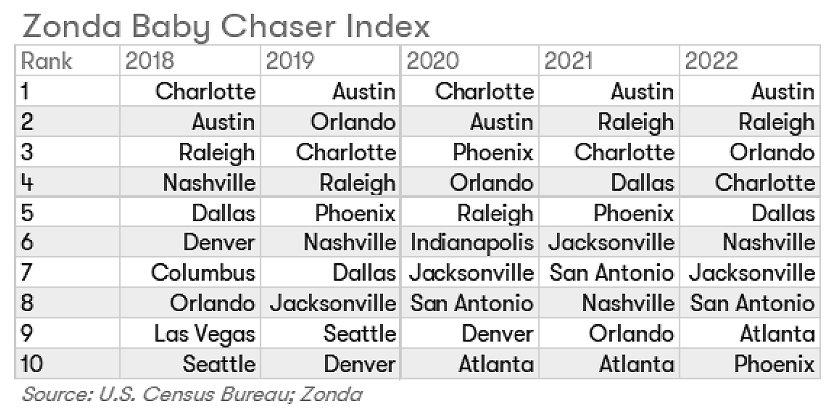

An especially interesting factor is the intersection between millennials and boomers, respectively the largest and second largest living generations. Consumer research indicates that about 25% of boomers plan to retire and then move to where their grandchildren live. Wolf called this group “baby chasers.” The chart below shows where there’s the most overlap between these two groups, and a big factor here is an overall move from more expensive housing markets to less expensive ones.

It's clear that although affordability and high interest rates are significant challenges and impacting the market, many people are still finding a way to buy a new home because they don’t want to put their lives on hold.

The local experts at Builders FirstSource can help you develop a strategy to target these demographics.